Our Fees, Explained Simply

No hidden costs. No surprises. Just transparent pricing.

No Separate Financial Planning Fees

How We’re Paid

At Harvard Wealth Management, we believe great advice should be transparent, aligned, and easy to understand. We are a fee-only fiduciary — which means we are paid only by our clients and are legally obligated to act in their best interest at all times.

Our compensation is based solely on the assets we manage for you. We do not charge commissions, hourly fees, or separate financial planning fees.

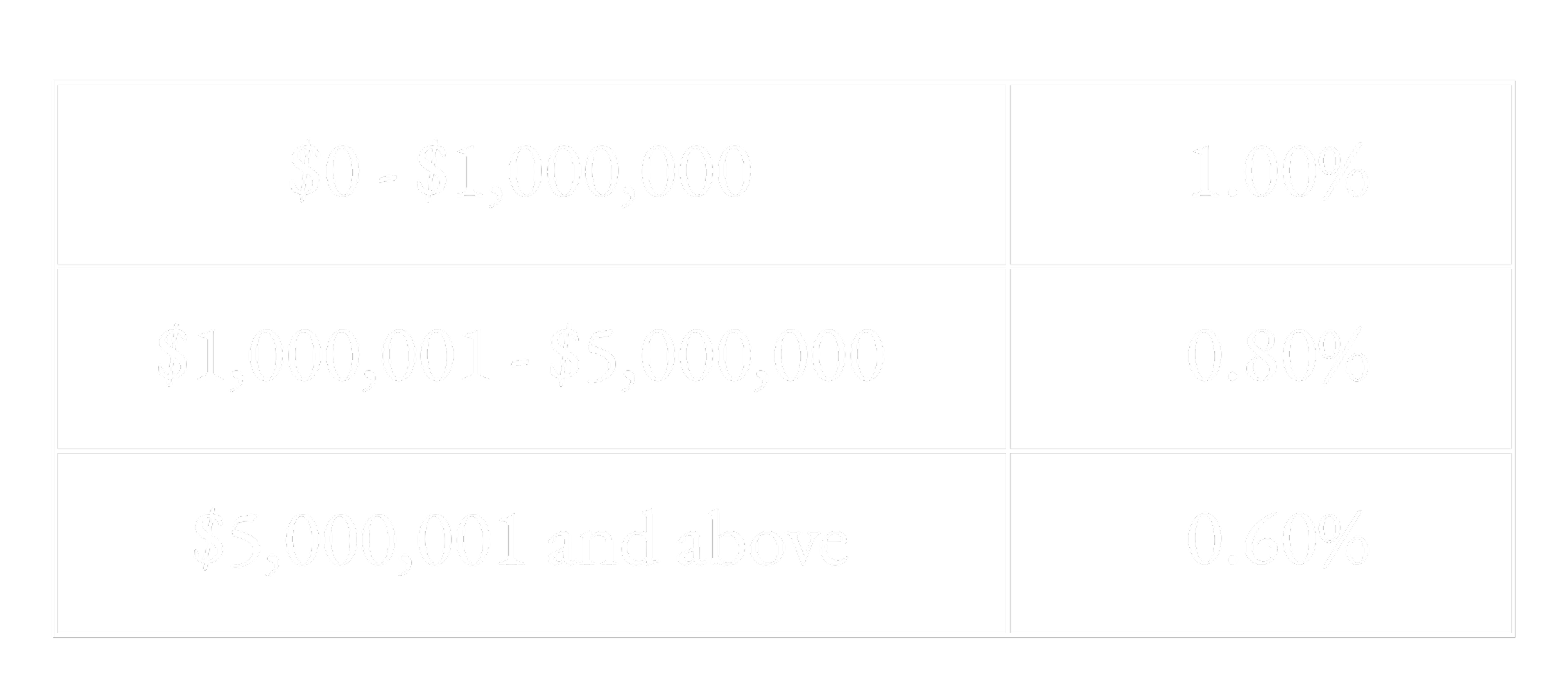

Our Advisory Fees

Our investment advisory fee is tiered, so as your assets grow, your effective fee declines.

Fees are billed quarterly in arrears and are calculated based on assets under management.

What’s Included

When you work with Harvard Wealth Management, financial planning is not an add-on — it’s part of the relationship.

Our advisory fee includes:

Professional investment management

Ongoing financial planning tailored to your goals

Retirement planning and cash-flow analysis

Tax-aware investment and planning strategies

Portfolio construction and rebalancing

Coordination with outside professionals

Regular review meetings and ongoing advice as your life evolves

You don’t pay extra for planning. You don’t pay by the hour. If we manage your assets, comprehensive financial planning is included.

What We Don’t Do

Our success is directly tied to yours — when your portfolio grows, we grow alongside you.

No Hourly Billing

No Commissions

No Product Sales

Is Harvard Wealth Management Right for You?

Our model works best for individuals and families who value:

Long-term, relationship-based advice

Integrated investment and financial planning

A fiduciary advisor with transparent pricing

If you’re interested in working together, we invite you to schedule an introductory call to see if we’re a good fit.